EACH EnterpriseBlog

BLOG

One Way to Get Into Trouble Administering Your Company’s Retirement Plan

by Eric Henon, President, EACH Enterprise

Summary

This article provides guidance for administrators of 401(k), 403(b), and 457 retirement plans on participant requests to reverse a cash distribution of plan assets in good order, even if the participant misunderstood the tax implications. The article outlines the legal, financial, operational, and fiduciary risks involved, and emphasizes the importance of maintaining plan integrity and compliance.

How the Story Starts

How the Story Starts

On a rare occasion, a plan participant may approach the service provider of their 401(k), 403(b), or 457 retirement plan after requesting a cash distribution of plan assets with all required documentation, asking that the good order transaction be reversed, arguing that they did not realize that income tax would be due and withheld at the time of distribution. However, a plan sponsor would be ill-advised to authorize such a request that would expose them to fiduciary risk.

Tax Withholding Is Irrevocable

Once a distribution is processed, federal income taxes are withheld and sent to the IRS immediately. These funds are no longer under the plan’s control. Reversing the transaction would require a reimbursement from the IRS—something neither the plan sponsor nor the service provider is authorized or equipped to request. Participants must resolve any tax overpayment through their personal tax return.

Custodial and Banking Barriers

After distribution, funds are typically deposited into a participant’s personal account. They may be spent, moved, or invested. Even if a participant agrees to return the money, retrieving and reprocessing it is complex and unreliable. This introduces unnecessary risk to the plan and its fiduciaries.

Operational Complexity and Cost

Reversals are not simple. They require recalculating taxes, issuing corrected tax forms (e.g., 1099-R), updating plan records, and coordinating across multiple departments. These tasks are time-consuming and costly, diverting resources from core operations and potentially increasing fees for all participants.

Audit and Regulatory Risk

Reversing a distribution can raise red flags during audits by the Department of Labor (DOL) or independent auditors. It may be viewed as a prohibited transaction or operational failure, exposing the plan to penalties and reputational damage.

Fiduciary Risk and Precedent

Making exceptions based on participant misunderstandings sets a dangerous precedent. It opens the door to future claims and undermines the consistent application of plan rules. Fiduciaries must act in the best interest of all participants—not just one.

Disclosure Obligations Are Met

Participants receive clear documentation about tax implications, including Summary Plan Descriptions, distribution forms, and IRS Form 402(f) Special Tax Notice. The plan’s responsibility is to provide this information—not to ensure it is read or understood.

Conclusion

While participant confusion is unfortunate, reversing a legally executed distribution in good order is not the answer. The risks far outweigh the benefits. Upholding the integrity of plan operations protects everyone—sponsors, fiduciaries, and participants alike.

Write to Eric Henon at ehenon@eachenterprise.com

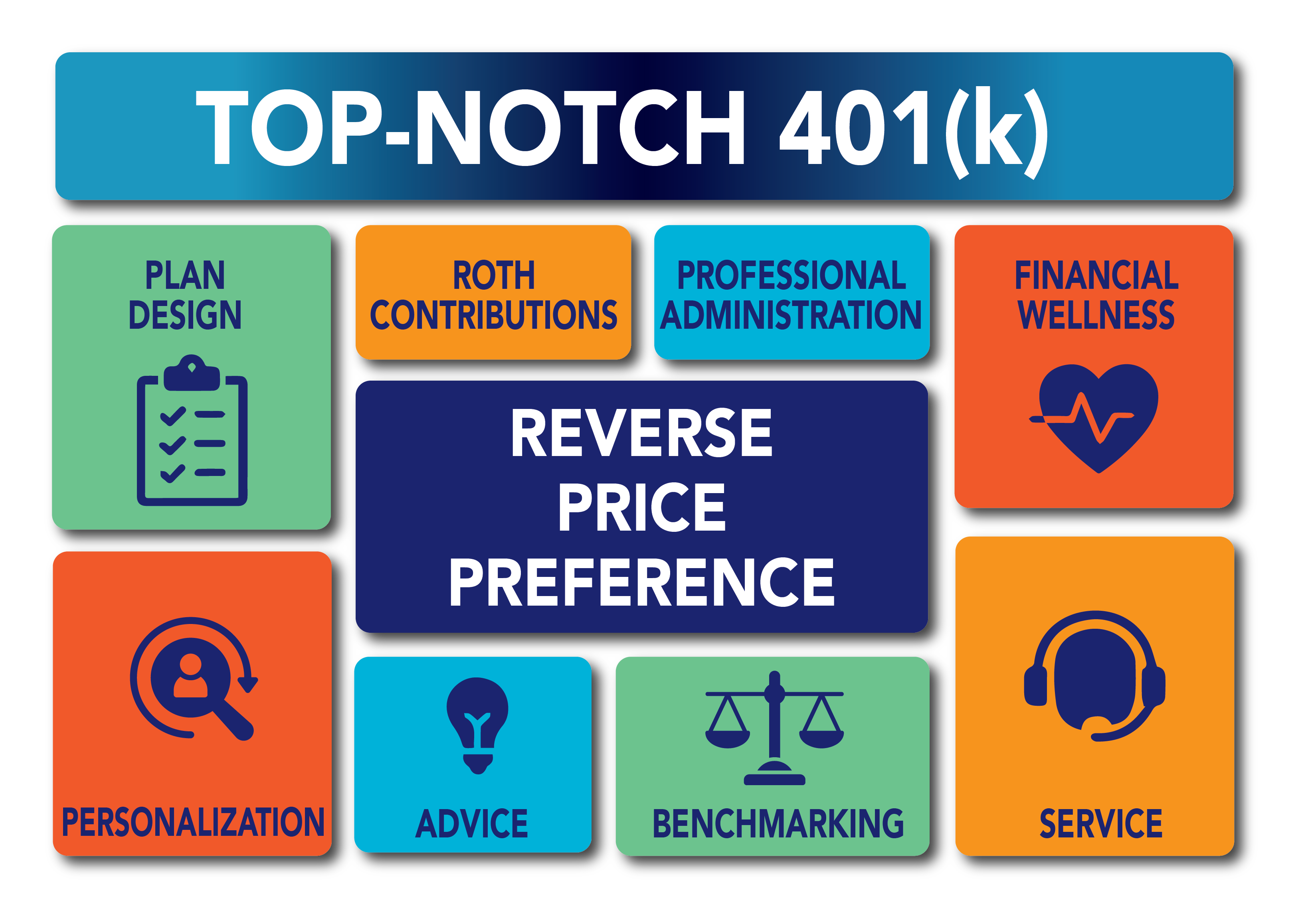

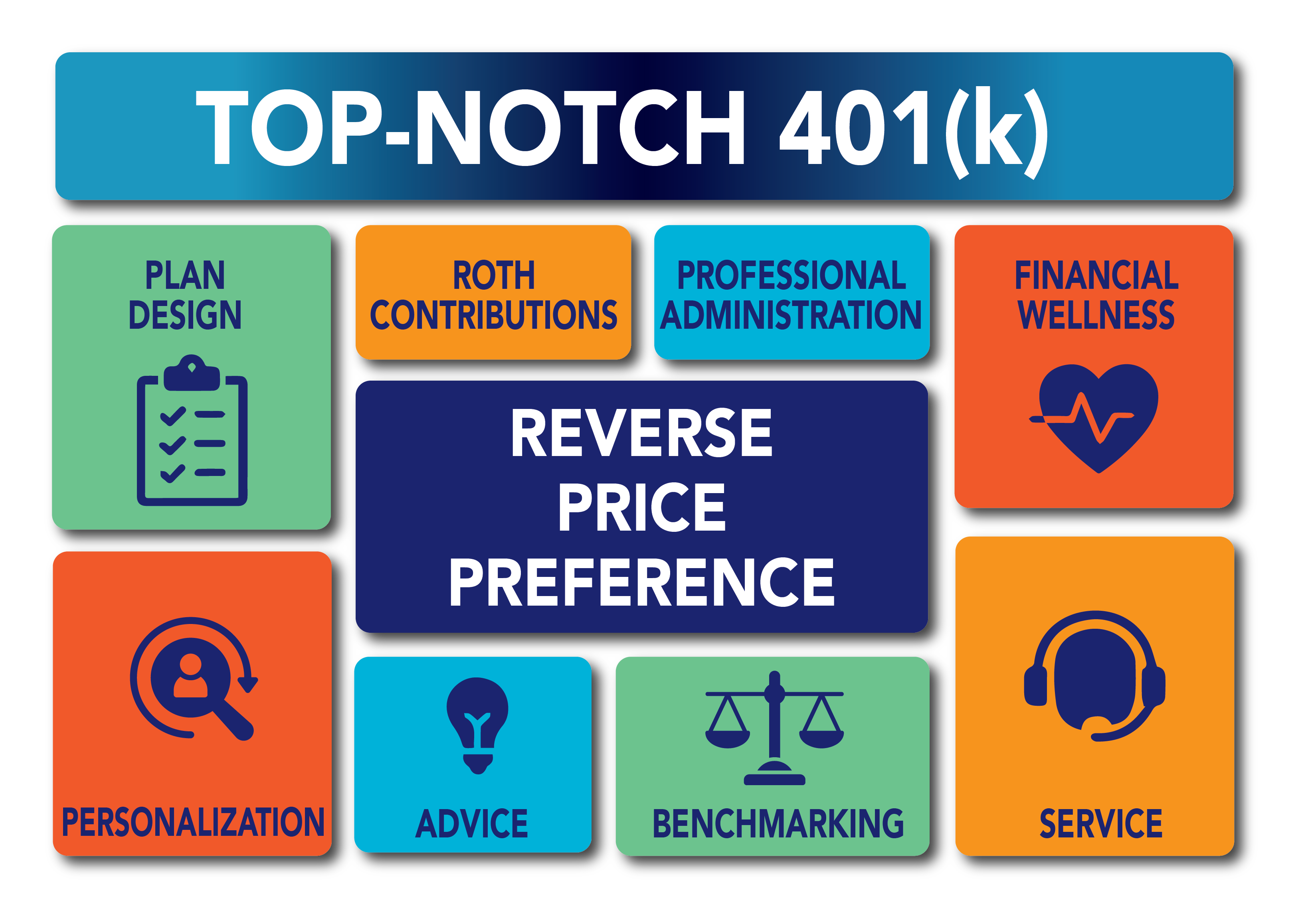

THE BEST 401(k) PLAN THAT MONEY CAN BUY

AI will tell you that the best 401(k) money can buy has low fees but I take exception to this. A plan sponsor is expected to act in the best interest of participants, and the best interest of participants is for the plan sponsor to pay for most if not all fees associated with plan administration. Plan sponsors who pay most if not all fees are going to look for the best service their money can buy.

The best plan that money can buy necessarily delivers superior outcomes for participants, in terms of their ability to retire comfortably and at a reasonable age.

- Plan design – money purchase or cash balance plan, combined with a 401(k) plan, and an NQDC plan for highly compensated employees and those earning more than $145,000 who are constrained by legislation. Default options that will lead participants to success (especially long-time employees who entered the plan late, or did not save enough for retirement for no fault of their own).

- Roth contribution types are a necessity post SECURE 2.0, to allow employees with FICA wages over $145,000 to make catch up contributions. Roth account balance accumulate tax deferred, and are not subject to income tax at the time of distribution. Roth is a tax-efficient alternative to retail brokerage accounts invested in equity with a buy-and-hold strategy to avoid short-term capital gain tax liability.

- Comprehensive financial wellness counseling to guide participants in a wide range of life situations through tough financial decisions caused by personal hardship, dependent care responsibilities, unfavorable tax treatment, or exceptional exposure to cyberfraud

- Personalizable investment options, including asset allocation models that include an allocation to alternative asset classes uncorrelated with bond or equity returns. Yes, that might include an allocation to private equity, private real estate, private debt, and maybe perhaps select crypto investments.

- Retirement income counseling that encompasses all options available – in and out-of plan – to act in the best interest of participants, and to empower pre-retirees to access retirement success regardless of stage in the equity market cycle.

- Professional administration. If the plan sponsor does not employ a dedicated retirement plan specialist with extensive experience running retirement plans, retain the services of a professional administrator who accepts ERISA 3(16) fiduciary, and maybe even 402(a) fiduciary status. Why not? These services can be obtained through a Pooled Plan Provider in the context of a PEP plan or in a single employer plan.

- Exceptional plan sponsor service – Client Relationship Manager who reports to the plan fiduciary and delivers recommendations to decision makers that help them act in the best interest of participants and responsive day-to-day account manager who answers questions promptly. Both act as a well connected team that communicates frequently, leveraging technology such as Salesforce and MS Teams.

- Plan and investment advice from the very best. The best plan advisors are connected with the best stakeholders in the industry and know how to create partnerships that enhance total value, not just the sum of its parts. Specialists have the knowledge to discern superior quality from low-cost, and at-par service performance.

- Frequent benchmarking to verify that outcomes are in the top decile, and services are top-notch, up-to-date, and the best that money can buy.

Yes, the solution could be the most expensive in the market. When the plan sponsor covers all the fees, considering only cost does not act in the participants' best interest. For sponsors so fortunate to operate in a sector or market that requires the best talent that money can buy, indeed, the retirement plan also should be the best that money can buy, and it could be the most expensive option available. Why wouldn’t you get the best for your employees if you can afford it?

If your employees merit it and you can afford it, buying them a Rolex® time piece at retirement is a great choice.

The Word of the month for May 2025 is "Equity Wash"

Check out the definition of Equity Wash in the glossary. An equity wash is a rule that requires a plan participant to move money from a stable value fund to a non-competing fund (like an equity fund) for a set period (usually 90 days) before it can be exchanged into a competing option (like a money market fund or short-term bond). It is designed to protect both participants and the stable value fund from the impact of “yield chasing” between investment options.

A stable value fund may have higher or lower yields than money market funds or even short-term bonds. However, in times of fluctuating interest rates, stable value funds can earn less, tempting participants to switch to money market funds. Without an equity wash, this switch could force the stable value fund manager to sell the underlying securities for prices that may hurt the fund's stability for everyone. To avoid this issue, many plan sponsors only offer either a stable value fund or a money market fund.